Life Insurance in and around Gary

Insurance that helps life's moments move on

Life won't wait. Neither should you.

Would you like to create a personalized life quote?

Your Life Insurance Search Is Over

Think you are too young for life insurance? Actually, it’s the opposite! You miss out on lots of benefits by waiting. That’s why your Gary, IN, friends and neighbors of all ages already have State Farm life insurance!

Insurance that helps life's moments move on

Life won't wait. Neither should you.

Agent Sharon Chambers, At Your Service

Life can be just as unexpected when you're young as when you get older. That's why now could be a good time to get Life insurance and why State Farm offers a couple of different coverage options. Whether you're looking for level or flexible payments with coverage to last a lifetime or coverage for a specific number of years, State Farm can help you choose the right policy for you.

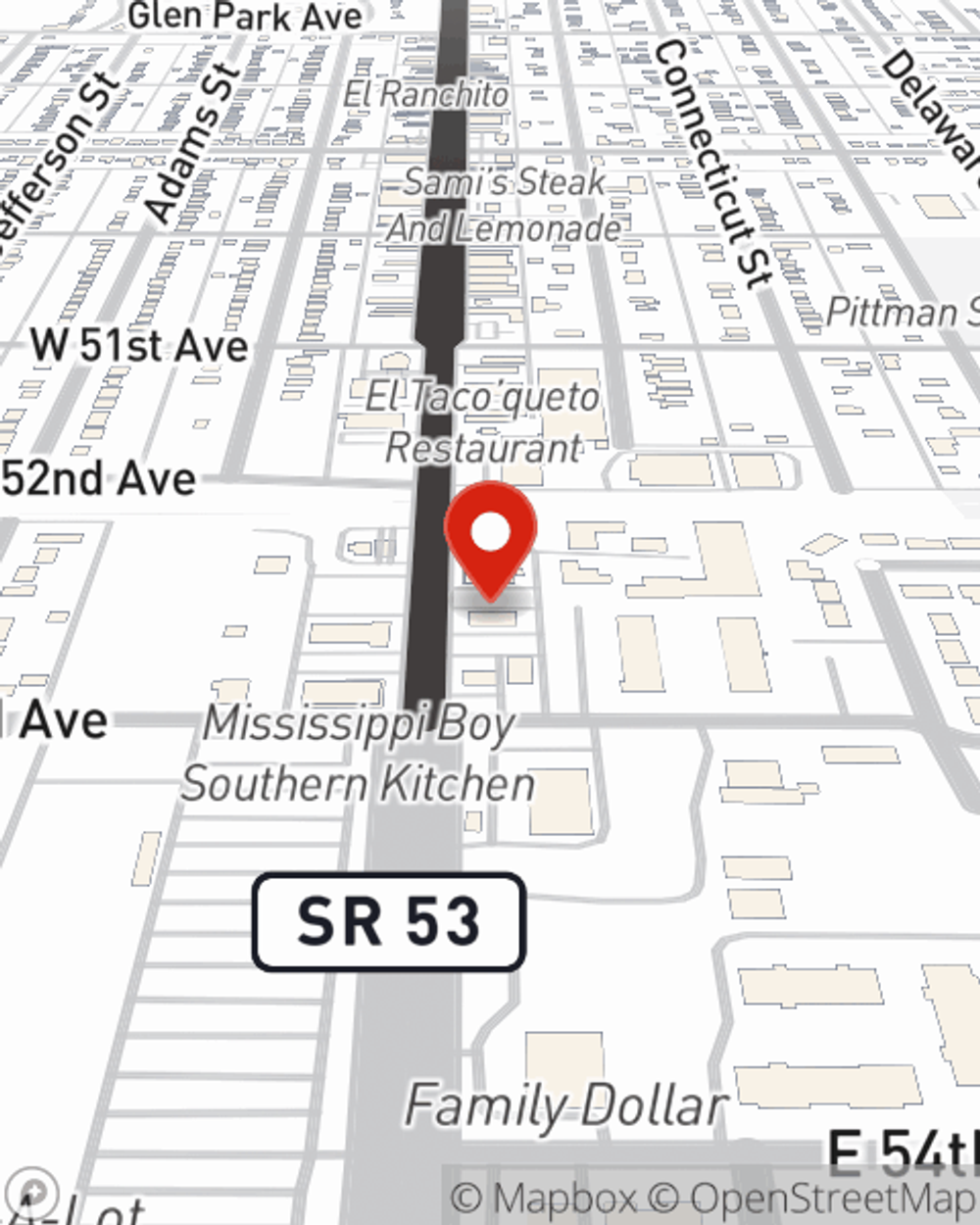

As a commited provider of life insurance in Gary, IN, State Farm is committed to protect those you love most. Call State Farm agent Sharon Chambers today for a free quote on a life insurance policy.

Have More Questions About Life Insurance?

Call Sharon at (219) 981-3111 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Building a special needs estate plan

Building a special needs estate plan

Setting up a special needs plan for a child or adult is critical. Consider a special needs lawyer to ensure protection and thoroughness of your plan.

What is survivorship universal life insurance?

What is survivorship universal life insurance?

Survivorship universal life insurance can be used for legacy/estate planning, business transitions, charitable giving and more.

Sharon Chambers

State Farm® Insurance AgentSimple Insights®

Building a special needs estate plan

Building a special needs estate plan

Setting up a special needs plan for a child or adult is critical. Consider a special needs lawyer to ensure protection and thoroughness of your plan.

What is survivorship universal life insurance?

What is survivorship universal life insurance?

Survivorship universal life insurance can be used for legacy/estate planning, business transitions, charitable giving and more.